Part time income calculator

The TTD rate for a full-time employee is computed at 6667 of the higher of the. If you make 55000 a year living in the region of California USA you will be taxed 11676.

Hourly To Salary Calculator

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Posted on January 31 2022. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Multiply the number of hours worked each week by your hourly pay rate to discover your weekly salary.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. That means that your net pay will be 40568 per year or 3381 per month. That means that your net pay will be 43324 per year or 3610 per month.

Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. How to calculate annual income.

Once you submit your application we will. Yes you can use specially formatted urls to automatically apply variables and auto-calculate. So a freelancer with a day rate of 150 would have a pro rata salary of 39000.

For example if you work 15 hours each week at a pay rate of. Hourly rate at the time of injury including a shift differential if in effect when. Part-time income tax calculator.

Income qnumber required This is required for the link to work. 57 rows Here are the steps to calculate annual income based on an hourly wage using a 17. How Your Paycheck Works.

But calculating your weekly take-home pay. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. To decide your hourly salary divide your annual income with 2080.

See where that hard-earned money goes - Federal Income Tax Social Security and. We developed a living wage calculator to estimate the. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week.

For example if an employee earns 1500. It can be any hourly weekly or.

What You Need To Know About An 8 Hour Workday Calculators

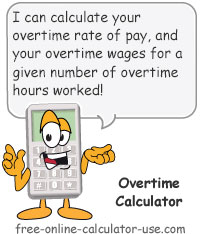

Overtime Calculator To Calculate Time And A Half Rate And More

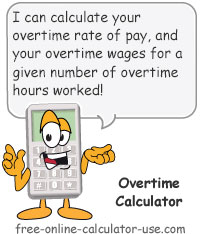

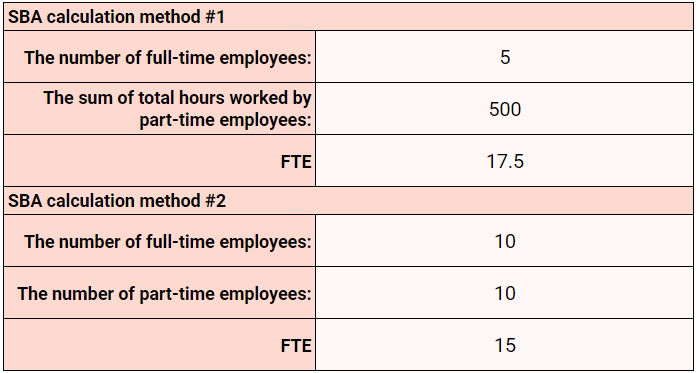

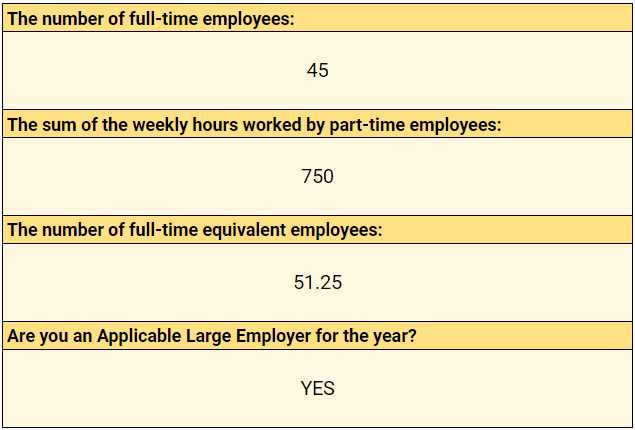

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Calculate Gross Income Per Month

Salary Formula Calculate Salary Calculator Excel Template

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Hourly To Salary What Is My Annual Income

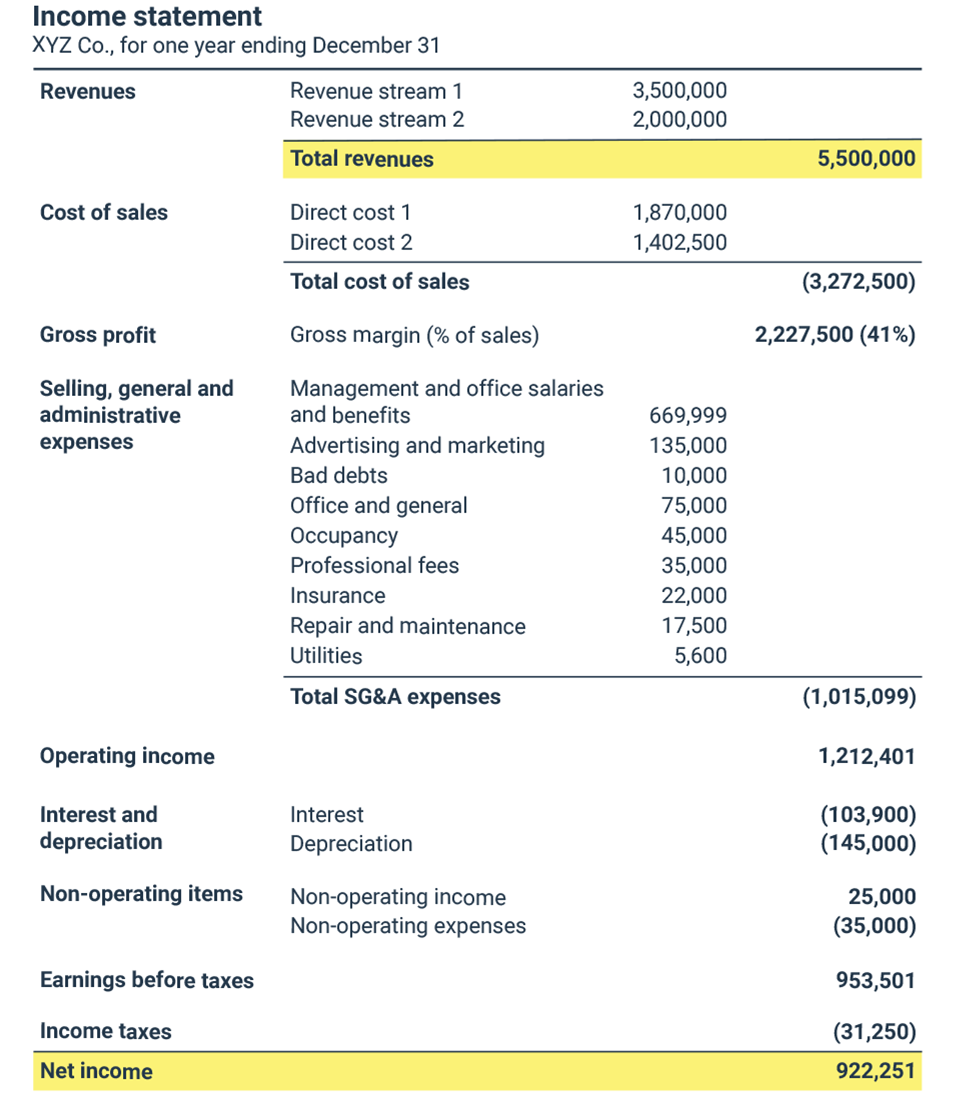

Net Profit Margin Calculator Bdc Ca

Annual Income Calculator

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Net Profit Margin Calculator Bdc Ca

Annual Income Calculator

17 An Hour Is How Much A Year Can I Live On It Money Bliss

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

How Much Should I Save For 1099 Taxes Free Self Employment Calculator